Central America’s Digital Transformation of Channels

The bank, with an extensive branch network spanning Central America, embarked on a project to elevate its credit evaluation and granting processes. The goal was to automate these processes within its branches, enabling real-time assessment capabilities.

Trusted by 120+ clients

Let's start

discussing your needs

Let’s transform your development ideas into reality.

Fill out the form to get started!

Project

Summary

The objective was to automate procedures, ensuring real-time assessments while adhering to credit policies, and mitigating associated risks. The challenge involved overhauling the credit evaluation process to be accurate and comprehensive. This required integration with existing systems and a new process design aligned with credit policies.

Challenge

The challenge lay in revolutionizing the credit evaluation process to be faster, more accurate, and more comprehensive while integrating with existing systems and procedures. The bank was in need of:

Streamlined

Process Redesign

Strategic

Implementation Methods

Specialized

Talent

Adaptive

Transformation

Let's start discussing

your tech iniciatives.

Solution

Our collaborative solution involved a specialized team proficient in:

Microsoft

Visual Basic

Extensive Knowledge of

the Core Banking System

and the Financial Sector

Credit

Processes

WillDom's Differential:

Acting as a strategic partner, our ability to provide specialized talent improved credit processes. The comprehensive approach ensured perfect alignment with the bank’s objectives and regulatory requirements.

In Conclusion:

Our all-encompassing approach perfectly matched the bank’s goals and rules. This sets the stage for continuous improvement, making the bank a leader in credit services. By blending technology and efficient processes, the bank is well-prepared for the ever-changing financial landscape

If your organization seeks to transform and thrive in the digital era, WillDom is the strategic partner that can drive your success.

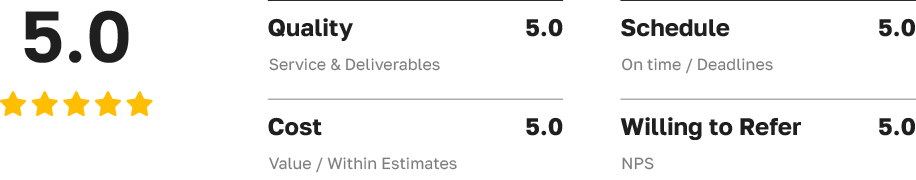

Ratings

Case Studies

Discover More WillDom Case Studies

Travel Hospitality & Leisure

McDonald’s is the world’s leading global foodservice retailer with over 37,000 locations in over 100 countries. More than 90% of McDonald’s restaurants worldwide are owned and operated by independent local business.

Business Services

Nestlé, the world’s largest food & beverage company, stands as a multinational food product manufacturing giant. Operating in 70+ countries, Nestlé remains committed to providing quality food products that cater to varied tastes and preferences.

Internet & Technology

GoDaddy is a leading technology company specializing in web hosting, domain registration, and online solutions for businesses and individuals worldwide.

Business Services

SKF is the biggest bearing maker globally, with a massive team of 44,000 people working in 108 manufacturing units. They top the charts with the largest distributor network in the industry, spreading across 130 countries.

Business Services

Since 1969, Sephora has epitomized empowerment and the impact of beauty. As the world’s top beauty retailer and part of LVMH, it leads with 3,000 stores in 36 markets, 31 websites, and 300 beauty brands.

Education

The University of California, Berkeley, embarked on a mission to create an innovative digital platform called AppCivist, to empower citizens, organizations, and policymakers to collaborate and drive positive social and political change.

Business Services

R/GA, a subsidiary of Interpublic Group of Companies, is a renowned global creative and innovation consulting firm that aims to provide cutting-edge digital solutions to its diverse portfolio of clients in various industries.

Media & Entertainment

Pluto TV, a Paramount Company, leads free streaming TV with live channels and on-demand content worldwide. Partnering with 400+ media firms, it offers diverse genres, accessible on mobile and connected devices.

Education

Protranslating is a major player in the language space, translating over 150 million words per year, with over 500 people touching products daily.

Internet & Technology

Slik offers unparalleled flexibility, customization, and user-friendliness, ensuring a truly rewarding experience for every team member.

Wellness & Fitness

OutFit is a prominent player in the outdoor fitness industry, known for their commitment to promoting a healthy and active lifestyle. They cater to fitness enthusiasts seeking a distinctive outdoor fitness experience.

Wellness & Fitness

With a mission to provide top-tier training products and workout programs accessible to all, TRX caters to a diverse audience. Their reach spans from fitness professionals and enthusiasts of every age and skill level to renowned athletes in the NFL, NBA, MLB, and UFC.